Finding the Best Rate to Send Money to Mexico: Comprehensive Guide

Finding the best rate to send money to Mexico requires an overview of the companies that are in the remittance business.

Although today, there are dozens of options, it always remains an important task to find the best rate to send money to Mexico.

From the traditional ways, through businesses only dedicated to the area, to the modern options through cryptocurrency wallets; the public has to choose from.

If you live in Europe or the United States, we will tell you in general terms the best rate to send money to Mexico.

In fact, the remittance sector has become a fundamental part of the Mexican economy, representing an important source of income for thousands of families in the country.

In this article we will give you a guide, so you can find the best rate to send money to Mexico and help your family and/or friends.

The exchange rate in Mexico

The first thing we must know, and surely you know them, is how to know the exchange rate, or those that may exist in the market.

The exchange rate in Mexico revolves around the dollar, and therefore, we must be certain of these data that change daily and thus find the best rate to send money to Mexico.

The exchange rate is the exchange rate of the dollar against the Mexican peso, taking the United States currency as a reference, due to the link it has for the Mexican productive sector.

The exchange rate in Mexico is generally expressed in the form of currencies, where the first currency is called the base currency and the second currency is called the quoted currency.

In this sense, in Mexico it is a floating exchange rate. It means that the value of the currency is determined by market forces, such as supply and demand, and can fluctuate constantly.

Regarding the euro, it will depend on the price of the dollar, and how it is priced with respect to the European currency and its subsequent exchange to dollars.

There are several ways to know the exchange rate in Mexico, but the main one is the banks, and some companies dedicated to the foreign exchange sector.

READ HERE: CAN YOU WORK IN CALIFORNIA WITHOUT BEING A RESIDENT?

As you will remember, the price of the dollar varies according to the market, so there will be seasons with a drop in the price of foreign currencies or weeks with a rise.

On the other hand, there is a fundamental point when looking for the best rate to send money to Mexico, and it is that, the companies that make exchanges, have different rates in their commissions, consequently, the amount can have an adjustment.

For example, Western Union has a commission rate, which will depend on the destination and/or taxes of each country.

Therefore, it is not only enough to know the exchange rate in Mexico, but also the company’s commission for the service provided.

To know a little more about the exchange rate and how to have a better understanding, you can do it through Investopedia (https://www.investopedia.com/terms/e/exchangerate.asp).

Main services for sending money to Mexico

One of the most important aspects of finding the best way to send money to Mexico lies in the way you do it.

Thus, you can find bank transfers, money orders, and even digital wallets.

The latter have become more common because they have a bank-to-bank link, or an intermediary through an automated system.

You can use international transfer services offered by banks or financial institutions. Be sure to check the applicable fees and exchange rates before making the transfer.

Here are the options for sending money to Mexico:

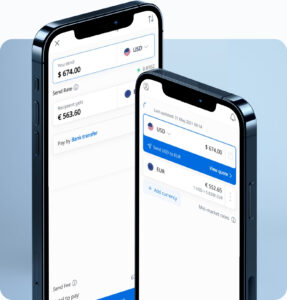

Online money transfer platforms: there are numerous online platforms that offer money transfer services quickly and securely.

These platforms allow you to send remittances to Mexico from anywhere in the world using your cell phone or computer.

Mobile money transfer applications allow you to transfer funds directly from your smartphone to bank accounts in Mexico.

In many cases you only need to upload your data; try to have a reference of these applications as much as possible.

Other traditional companies have been updating and making available applications for this purpose, such as Western Union, which used to require you to go to an office; for some years now you have been able to do it from your home.

Thus we find companies such as:

- Wester Union.

- Wise

- Several banks in Mexico, such as Banco Azteca.

- MoneyGram

- Ria

- World Remit

Best Rate to Send Money to Mexico: Rates and Comparisons

When it comes to rates to find the best way to send money to Mexico, each company has its own particularity.

For example, Boss Revolutión manages an excellent market rate and the fee for the service is quite low compared to other companies.

Another case is Pagaphone Smart Pay, which stands out for its effectiveness but charges a $7.99 commission.

READ MORE: CAN A SPANISH CITIZEN WORK IN THE US?

Moneygram charges a fee of $5.99, its reputation for security is unmatched.

In 2023, Xoom was considered the remittance company that paid the least,” but with a $3.99 fee.

Pangea Money Transfer is fast, simple and affordable, charging a $3.95 fee.

In the case of Western Union, everything depends on the amount, i.e. the amount of money to be sent. But one aspect in favor of this company is that it handles rates very close to the average price of the dollar or the euro.

Most of these companies have a tabulator or calculator, so you should have no problems sending money and knowing the amount received.

Tips that will let you know: The best rate to send money to Mexico

Research and compare the rates and exchange rates offered by different remittance providers. This will help you get the best value for money when sending money to Mexico.

Check the reputation and reviews of remittance providers before making a transaction. Opt for reputable and reliable companies to ensure the safety of your money.

Be sure to provide accurate and complete information about the recipient in Mexico. This includes the full name, address, bank account number and any other information required by the remittance provider.

Keep a record of all transactions made, including reference numbers and proof of payment. This will be useful in case of any future problems or queries.

Use strong passwords and protect your electronic devices when making online remittance transactions.

It is important to keep your devices up to date.