At issue: Firing of Wells Fargo employees

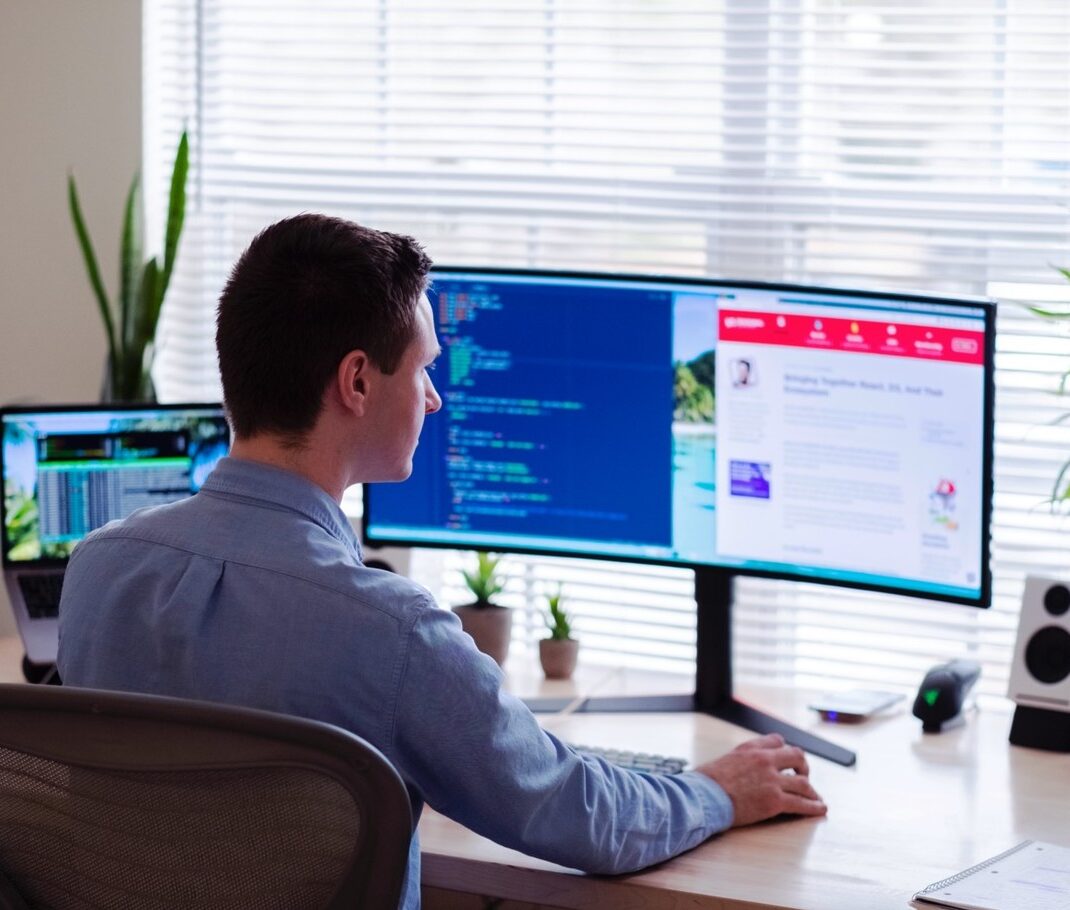

The firing of Wells Fargo employees has sparked controversy, as the workers were reportedly using an App to simulate working on the PC.

Wells Fargo revealed this week that it had fired more than a dozen employees for “simulating keyboard activity,” Bloomberg reported.

That’s how it came out according to filings with the Financial Industry Regulatory Authority.

That is, the employees were pretending to work, possibly with a device that can be purchased online for US$20.

The firing of employees at Wells Fargo, one of the strongest companies in the United States, highlights the low work culture in the wake of the pandemic.

The firing of Wells Fargo employees apparently comes after it was discovered that the use of devices, which keep the screen active and move the cursor in convincingly random ways, became very popular during the early days of the pandemic.

Since employees were no longer huddled under fluorescent lights, eating sad salads at their desks, bosses suddenly had to figure out whether their teams were really working or slacking off.

At issue: Firing of Wells Fargo employees

Although most workers said they were more productive from home, many executives adopted “boss software” to monitor their staff’s laptops.

READ HERE: EBAY WILL NO LONGER ACCEPT AMERICAN EXPRESS PAYMENTS

In any case, some Wells Fargo bank employees appear to have been caught last month.

It is unclear whether they were working from home or from the beach, or what they were doing instead of working.

A spokesman for the bank declined to offer further details about the firings, saying only that “Wells Fargo holds its employees to the highest standards and does not tolerate unethical behavior.”

In Wells Fargo’s case, managerial distrust would be understandable, given the bank’s history.

Since 2016, Wells has spent billions of dollars settling civil and criminal charges related to a multi-year scheme that led to the opening of more than two million fake accounts without customers’ consent or knowledge.

Last year, the bank’s former head of retail operations was sentenced to three years probation, while the bank’s former chief executive officer was banned from the industry.

Since then, Wells has been trying to reform its own internal culture as it attempts to repair the damage to its brand. It’s not hard to understand why it wants to keep a close eye on its roughly 200,000 employees.

Banks in particular have strict controls over work-provided devices because the industry is highly regulated.

But firing employees for keyboard movement simulator systems may not be the best way to foster a work culture based on trust and inclusion.